Investment managers who manage private employee benefit plan and individual retirement account (collectively, “Plan”) assets have long relied on Prohibited Transaction Class Exemption 84-14 (commonly referred to as the “QPAM Exemption”), which broadly permits such asset managers to manage such assets without engaging in a prohibited transaction under Section 406(a)(1)(A) through (D) of the Employee Retirement Income Security Act of 1974, as amended (“ERISA”) or Section 4975(c)(1)(A) through (D) of the Internal Revenue Code of 1986, as amended (the “Code”).

After a lengthy rulemaking process, the Department of Labor (“DOL”) published sweeping changes to the QPAM Exemption in the Federal Register on April 3, 2024.[1] The amendments to the QPAM Exemption fit within three categories: (1) requirements to be a QPAM; (2) obligations of the QPAM; and (3) rules regarding ineligibility. These amendments will be effective June 17, 2024.

ERISA practitioners currently speculate that these amendments may cause both smaller and larger asset managers to look to other prohibited transaction exemptions. The changes to the capitalization and assets under management requirements may prevent some smaller asset managers from relying on the QPAM Exemption. The changes made to expand conduct that could result in a QPAM being ineligible to rely on the QPAM Exemption could be particularly problematic for large, global financial institutions that may be subject to regulatory scrutiny across the globe.

I. Requirements to be a QPAM

The revisions change the requirements to be a QPAM by increasing the capitalization and assets under management requirements and requiring registration with the DOL.

a. Definition of QPAM

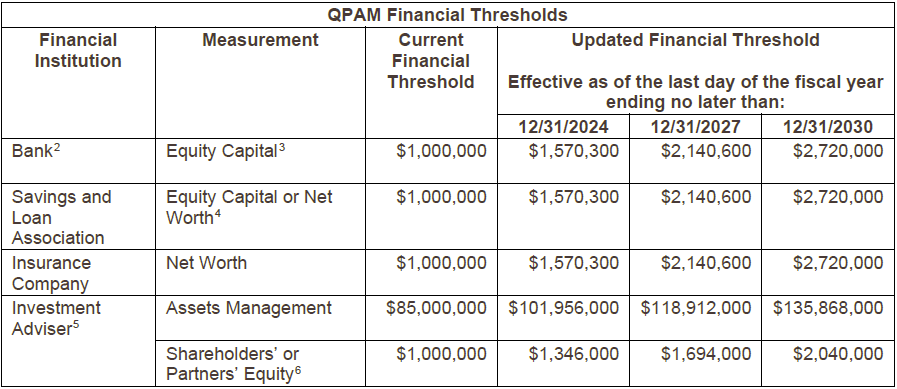

A Qualified Professional Asset Manager or a “QPAM” is defined to include certain regulated financial institutions that satisfy specific capitalization and asset management thresholds. These thresholds have not been updated since 1984.

The definition of QPAM is revised to increase the capitalization and assets under management requirements over the next six years, as shown below in the table. Additionally, the DOL will make subsequent annual adjustments for inflation to the Equity Capital, Net Worth, and asset management thresholds. These changes could prevent smaller asset managers from being able to rely on the QPAM Exemption going forward.

b. Registration Requirement

Each QPAM that relies upon the QPAM Exemption will be required to notify the DOL at QPAM@dol.gov. The notification is required to be made only once unless there is a change to the legal or operating name of the QPAM. Although this is a low-cost and relatively simple task, there is concern that this could increase the risk of a DOL examination.

II. QPAM Obligations

The DOL expanded the QPAM’s obligations to rely on the QPAM Exemption. First, the DOL clarified that the QPAM must have full responsibility for the applicable transaction. Second, the DOL added a recordkeeping requirement where the QPAM must maintain records demonstrating compliance with the QPAM Exemption for six years and provide access to such records to certain regulators and parties related to an applicable Plan.

a. QPAM Responsibility

Prior to the amendment, the QPAM Exemption required that the terms of the transaction be negotiated “by, or under the authority and general direction of, the QPAM” and “not party of an agreement, arrangement or understanding designed to benefit a party in interest.” Consequently, it has long been understood by most ERISA practitioners that a QPAM should not be used solely for purposes of “rubber-stamping” a transaction where there is an underlying goal to avoid the restrictions of the prohibited transaction rules. The amendments to the QPAM Exemption substantially expand upon this requirement.

The revisions require that the terms of the transaction and any associated negotiations be determined by the QPAM. Further, the QPAM is responsible based on its own independent exercise of fiduciary judgment and is free from any bias in favor of the interests of a plan sponsor or other parties in interest. The QPAM may not be appointed to “uncritically” approve transactions or investments that have been negotiated, proposed or approved by the plan sponsor or other parties in interest. No relief is provided where the QPAM does not have sole responsibility with respect to the transaction.

These revisions question the extent to which independent fiduciaries can be utilized to address inherent conflicts of interest and prohibited transactions that may arise in connection with a single anticipated transaction.

b. Recordkeeping

A recordkeeping requirement was added to the QPAM Exemption. The QPAM must maintain records necessary to demonstrate “whether the conditions of this exemption have been met with respect to a transaction.” Except to the extent the records contain privileged trade secrets, commercial or financial information of the QPAM or information identifying other individuals, the records must be available for examination by:

- Any authorized employee of the DOL or the Internal Revenue Service (“IRS”) or another state or federal regulator,

- Any fiduciary of the Plan whose assets are managed by the QPAM,

- Any contributing employer and any employee organization (i.e., union) whose members are covered by a Plan whose assets are managed by the QPAM, or

- Any participant or beneficiary of a Plan whose assets are managed by the QPAM.

To the extent the information is privileged or contains information identifying individuals such that the QPAM will not disclose the records, the QPAM must notify the requestor of the reasons for refusal and that the DOL may request such information by the close of the thirtieth day following the request.

III. Ineligibility Rules

The QPAM Exemption has always had a requirement that neither a QPAM nor any affiliate nor any owner of 5% or more of the QPAM may rely on the QPAM Exemption if any such parties had been convicted of certain crimes[7] (e.g., crimes of moral turpitude like fraud) within 10 years preceding the transaction. Consequently, numerous large financial institutions have had to seek relief from the DOL in the form of an individual prohibited transaction exemption (“individual exemption”) when the QPAM, or more commonly an affiliate, is convicted of any such crimes so that the QPAM can continue to rely on the QPAM Exemption.

The DOL has revised the QPAM Exemption to expand the types of misconduct that could result in a QPAM being ineligible to rely on the QPAM Exemption. It has also provided a transition period in the event a QPAM becomes ineligible, as well as specific policies relating to the request for an individual exemption.

a. Ineligibility Based on Criminal Conviction or Prohibited Misconduct

In the amended QPAM Exemption, “Criminal Conviction” was expanded to explicitly include convictions in a foreign court of competent jurisdiction (excluding convictions and imprisonment that occur within a foreign country that is included on the Department of Commerce’s list of “foreign adversaries”). There has been a question whether foreign convictions could result in ineligibility, but generally, the DOL has taken the position in the past that such foreign convictions do result in ineligibility.

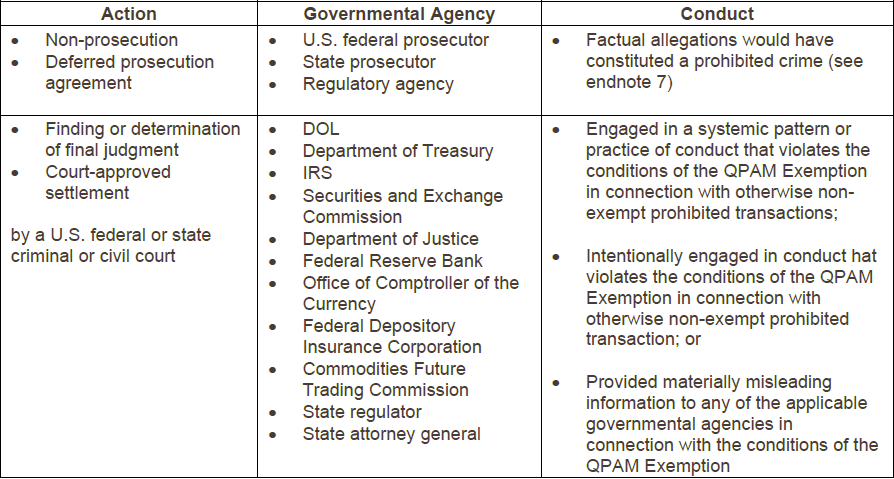

Further, the amended QPAM Exemption added the concept of “Prohibited Misconduct”, which will result in a QPAM being ineligible to rely on the QPAM Exemption. More specifically, a QPAM, any affiliate, or any owner of 5% or more of the QPAM who participates in or has knowing approval or knowledge of Prohibited Misconduct and does not take steps to prevent such misconduct can be found to be ineligible. Prohibited Misconduct includes the following:

This is a broad expansion of the type of matters that could result in a QPAM being ineligible to rely on the QPAM Exemption. Particularly, this may result in more large financial institutions being ineligible to rely on the QPAM Exemption without individual exemptions that may come with onerous requirements.

In the event a QPAM, an affiliate, or any owner of 5% or more of the QPAM participates in Prohibited Misconduct or enters into an agreement with a foreign government that is substantially equivalent to a non-prosecution agreement or deferred prosecution agreement, the QPAM must submit notice to the DOL within 30 days.

b. Consequences of a Criminal Conviction or Participating Prohibited Misconduct

If a QPAM becomes ineligible, it is required to provide a one-year transition period for its client Plans. During the transition period, if the QPAM complies with the conditions of the QPAM Exemption (including additional conditions during the transition period), the QPAM may continue to rely on the QPAM Exemption. Within 30 days of the ineligibility date, the QPAM must provide notice to the DOL and each client Plan of its ineligibility and agree to not restrict client Plans from terminating or withdrawing from the arrangement with the QPAM. Additionally, the QPAM may not impose fees or penalties for terminating or withdrawing from such arrangement, except for reasonable fees, disclosed in advance designed to prevent abusive investment practices or ensure equitable treatment amounts all investors in a pooled fund. Further, the QPAM must agree to specific indemnification and exculpation rights to the client Plans.

The QPAM may apply for an individual exemption to seek relief that is longer than the one-year transition period. When applying for relief, the QPAM must review the most recently granted individual exemptions that relate to ineligibility for the QPAM Exemption. To the extent the QPAM believes any of those conditions should not apply to it, it must provide a detailed explanation of why it should receive different conditions. Further, in the application for an individual exemption, the QPAM must detail specific dollar amounts of investment lost that may result from foregone investment opportunities resulting from the QPAM’s inability to rely on the QPAM Exemption.

[1] Amendment to Prohibited Transaction Class Exemption 84-14 for Transactions Determined by Independent Qualified Professional Asset Managers (the QPAM Exemption), 89 FR 23090 (3 April 2024).

[2] Bank is defined in Section 202(a)(2) of the Investment Advisers Act of 1940.

[3] Equity Capital means stock (common and preferred), surplus, undivided profits, contingency reserves, and other capital reserves.

[4] Net Worth means capital, paid-in and contributed surplus, unassigned surplus, contingency reserves, group contingency reserves, and special reserves.

[5] Investment adviser is registered under the Investment Advisers Act of 1940.

[6] In lieu of meeting the shareholders’ or partners’ equity thresholds, certain persons (including regulated financial institutions) can agree to unconditionally guarantee payment of all liabilities, including any liabilities that may arise by a breach or violation in ERISA Sections 404 and 406.

[7] Such convictions include: any felony involving abuse or misuse of such person’s employee benefit plan position or employment, or position or employment with a labor organization; any felony arising out of the conduct of the business of a broker, dealer, investment adviser, bank, insurance company or fiduciary; income tax evasion; any felony involving the larceny, theft, robbery, extortion, forgery, counterfeiting, fraudulent concealment, embezzlement, fraudulent conversion, or misappropriation of funds or securities; conspiracy or attempt to comment any such crimes or a crime in which any of the foregoing crimes is an element or any other crime described in Section 411 of ERISA.